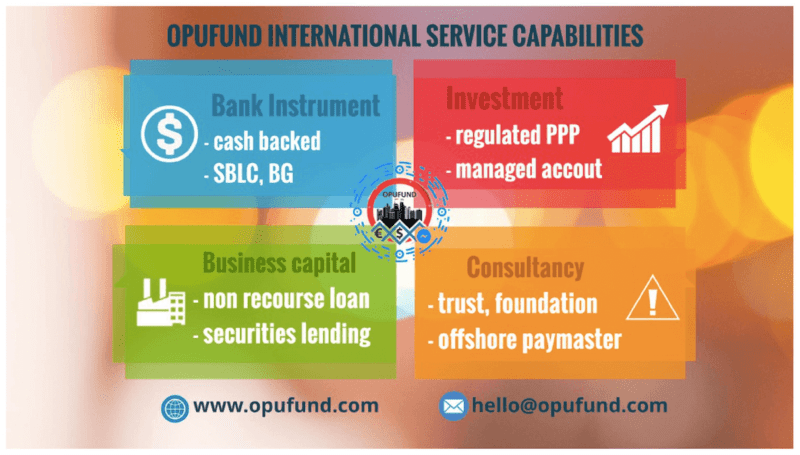

We receive many enquiries on what is Opufund business capabilities. So, we want to elaborate and explain once and for all. What is Opufund ? Opufund is the strategic partnership of 2 financial consulting companies with total added industry experience Read More …