There are many types of bank instruments in international business trade.

SBLC / BG

SBLC stand for Standby Letter of Credit, while BG is Bank Guarantee.

The Standby Letter of Credit (SBLC) or Bank Guarantee(BG) is an irrevocable bank instruments act as bank commitment to a third-party beneficiary and promising to pay on behalf of the original applicant a specific sum of money in the event that the bank’s client defaults on an agreement. It is a “standby” agreement because the bank will have to pay only in a worst-case scenario.

There are many uses of these letters, including supporting the payment of obligations or contracts, optimizing cash flow and liquidity, maintaining capital, making new business relationships easier, and maintaining your investment strategy. Many securities dealers use these letters of credit to ensure their securities.

SBLC and BG can enhance your ability to apply for a line of credit with your bank; in other words, business owner can provide it as collateral to the bank for project funding.

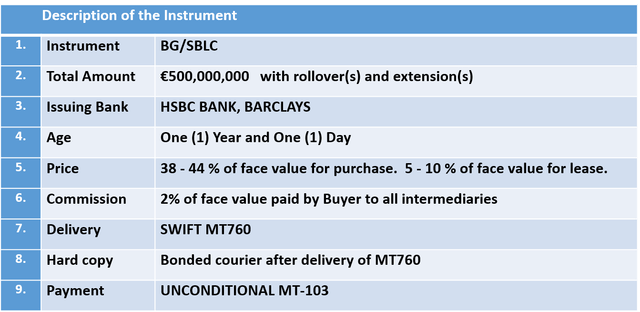

Top 50 banks in the world issue SBLC or BG for 1 year and 1 day, fresh cut and transfer bank-to-bank via SWIFT or Euro clear Networks.

Applications of SBLC / BG

-

- Purchase a SBLC / BG – for project funding

- Leased a SBLC / BG – as collateral, use for trade credit line

- Monetize a SBLC – for Private Placement Program trade