Investors, entrepreneurs and brokers who are looking for high return safe investments often contact us. Their enquiries are to provide high returns for themselves or their clients. Subsequently, this initial discussion often leads to the topic on private placement trade programs

Is Private Placement Trade Program(PPP) high return safe investments ?

To the untrained financial intermediary, they are curious and skeptical of private placement program (also known as PPP). This is because the trade program provides excessively high return in the range of 40-70% per month !

On the contrary, many private placement programs and trade platforms are legitimate investment vehicles that are accessible to a wide variety of investors.

In short, they are real, but not in the way they are often described. There are many myths about these programs that we will clarify.

What Private Placement Trade Programs are NOT :

- The most common misconception regarding private placement programs are these programs are for the exclusive domain of the ultra rich investors only.

- It is alleged that only the largest top-50 prime banks in the world are involved in this program.

- On top of that, these programs are secretive investments and the minimum investment must be in excess of $100 million or more.

- Moreover, investors are to pay large, upfront fees to gain access to these exclusive high return safe investments.

- More often than not, people associate PPPs as Prime Bank Bank Programs, also known as Prime Bank Investments, High Yield Investment Programs (HYIPs).

- Above all, investors will need to transfer large amounts of capital from deposit accounts into prime bank programs. And this mass movement of capital would cause the banking system to collapse.

- In addition, investors confuse private placement trade programs with Private Placement Memorandum (PPM). It is a set of investment documents for companies to raise capital from private investors.

What Private Placement Trade Programs really ARE :

- We have attached here an excellent explanation on private placement programs and trade platforms. Please note that we have no relationship with author or its principals. We provide this special report for educational purposes only.

- In fact, there is no upfront fee to pay for participate into Private Placement trade program.

- However, client must submit POF (proof of funds), a CIS (client information summary) or KYC (know your client) package, along with their passport for due diligence.

- This program is “risk-mitigated” investments. Where one prime bank issues discounted instruments to a purchaser, which a ready a exit buyer will purchase the notes at an agreed-upon price.

- With financial leverage of 10 :1., the trade program can achieve excessive return.

- Client never need to move or use money in the trade program transactions. Rather, This deposit is in a “blocked” account only until the trade transactions complete.

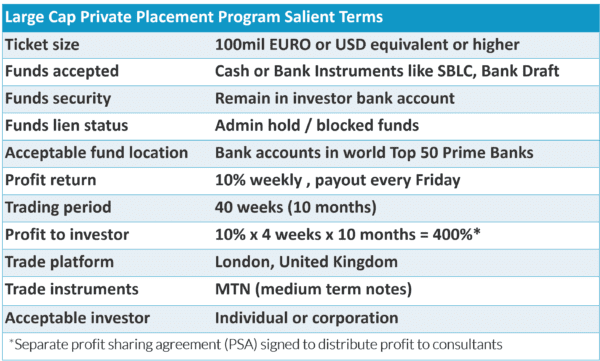

Large Cap Private Placement Program Terms

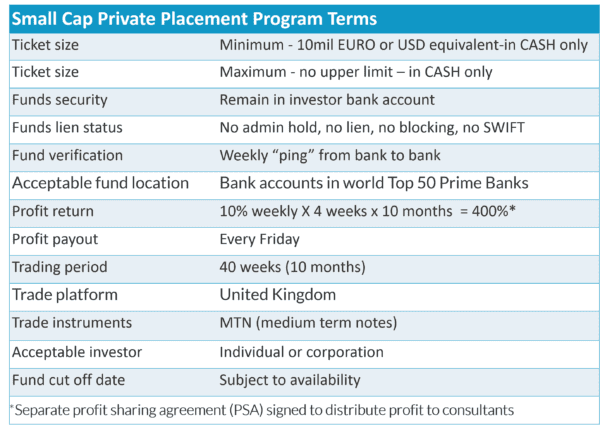

Small Cap Private Placement Program Terms

Procedures

- “Investor” complete KYC + Copy Passport + Current Bank Statement + ATV (Authorisation to Verify or Bank Confirmation Letter) + Introducers details.

- Telephone conversation with Trade Program Manager (if required)

- Platform to verify source of funds to be clean,clear of criminal origin

- Trade platform issue Contract

- Transaction commences

- Transaction operates while funds remain “blocked” in account

Loading…

Loading…